Finance

Warren Buffett’s techniques that no one talks about

The greatest investor of all times must have some tricks on his sleeve, and indeed he has. Check out these techniques.

Advertisement

One of the most renowned and successful investors of all time is Warren Buffett.

When he started buying Berkshire Hathaway shares at $7.60 per share in his early 30s, he had been investing in equities since he was 10 years old and had amassed a million dollars.

Berkshire currently trades at around $400,000, while Buffett is worth $97 billion.

Buffett is renowned for his strategy of purchasing sizable portions of blue-chip businesses with undervalued prospects and capable management. He keeps those shares for years or perhaps decades after that. He attributes his achievement to adhering to two rules:

Never losing money is the first rule. Never forget Rule No. 1 (Rule No. 2).

However, there are some minor acts that Buffett does that can help you increase even your results. Check out some of them.

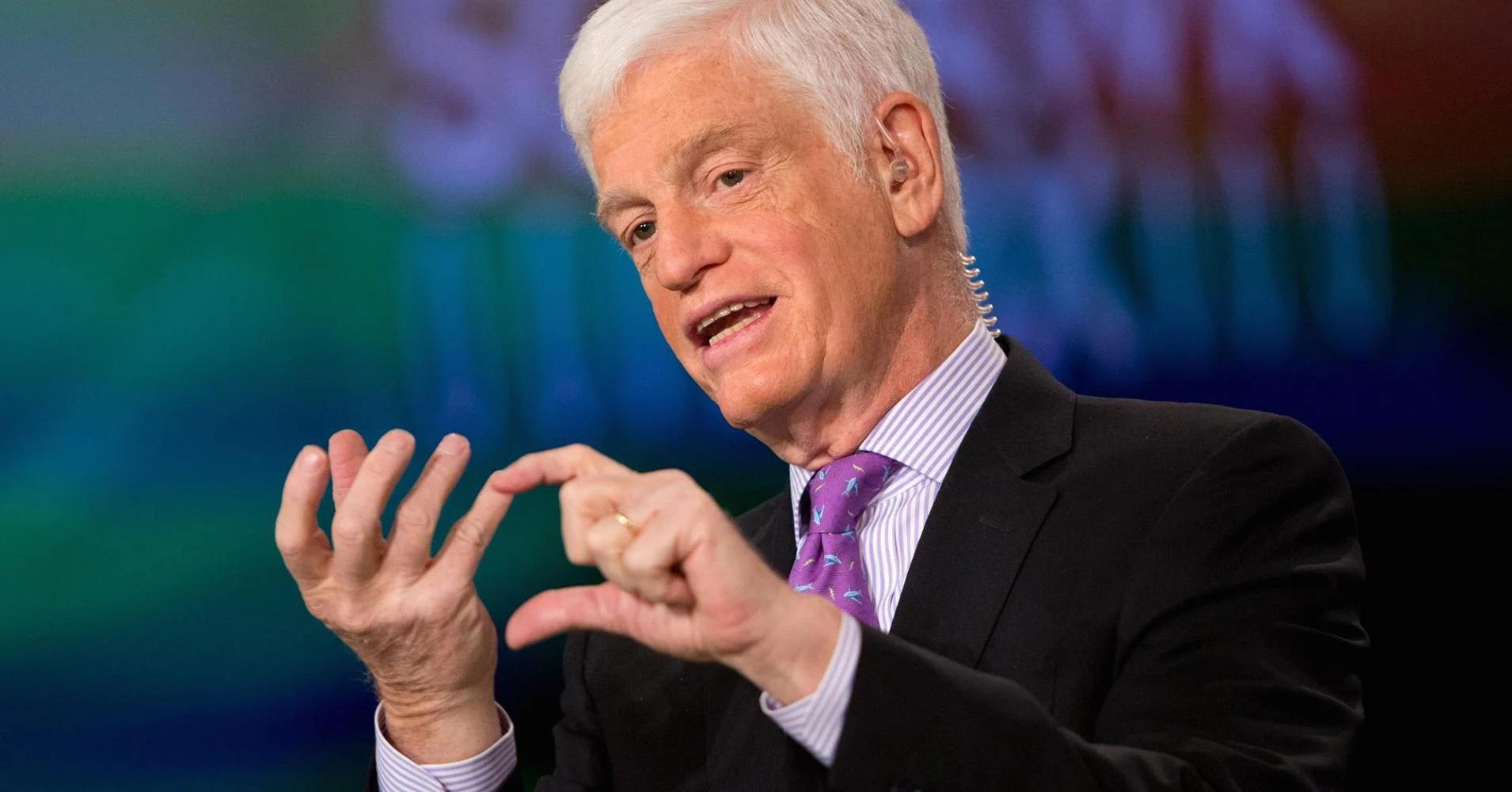

Mario Gabelli is liking these stocks

Billionaire investor Mario Gabelli shared some opinions about some stocks and a particular industry he is investing in. Check out now!

Cutting losses when necessary

Buffett’s “buy and keep” strategy does not include never acknowledging that even he makes mistakes.

When losses start to appear at a well-run corporation, it’s a clue that the business’s economics may have changed in a way that will result in losses for a very long period.

Buffett’s major error was aviation firms. All four of the main American airlines—Delta, American Airlines, Southwest, and United—were originally controlled by Berkshire Hathaway.

By the end of 2020, he had dropped all of the businesses he had only recently added to his roster, at a loss.

Buffett acknowledged the error of his ways but made it obvious that he saw no future for the airline business, even going so far as to refer to it as a “bottomless pit.”

At the time, he added, “We will not invest in a company that — if we think that it is going to eat up money in the future.”

You will be redirected to another website

Investing in small caps stocks

Acquiring shares of attractive rising companies won’t work if you’re spending billions of dollars on investments.

If the Oracle of Omaha made a purchase substantial enough to make it worthwhile for him to spend his time on, shares of small-cap growth stocks of companies typically worth $300 million to $2 billion would just move too much.

When considering his investing alternatives, Buffett once remarked, “I have to seek for elephants.” “It’s possible that insects are more alluring than elephants. But that’s the world I have to live in.

Shares show the fastest growth in the early stages of a company’s existence, which is one reason those alleged “mosquitoes” seem appealing.

Buffett may not be interested in those tiny dresses, but that doesn’t mean you can’t pursue them.

Selling put options

You would be foolish to assume that someone like Buffett, who appears to be devoted to blue-chip companies, would avoid complex derivatives.

Buffett has profited from the sophisticated option trading approach of selling naked put options as a hedging strategy during his entire investment career.

In fact, Berkshire Hathaway admitted in its 2007 annual report that it had 94 derivative contracts, the premiums from which totaled $7.7 billion for the year.

This approach entails selling an option that commits you to eventually purchase a stock at a set strike price that is lower than its current value.

As a result, you get paid right away when the option is sold. You keep the money if the share price doesn’t decrease.

When you buy the stock, you pay less than you would have at the time you sold the option because of the cash from the option sale, which lowers your overall cost even further if the price does go below the strike price.

Because they will purchase the shares at a lower price than your strike price and compel you to do so, the option buyer makes money.

Because you haven’t acquired another option to purchase the stock, such as by shorting shares of the same firm to reduce your purchase price, the option is seen as being “naked.”

But bear in mind that novice investors shouldn’t attempt this on their own considering the risk involved.

Trending Topics

Some of the most expensive paintings you probably could have painted yourself

There are some paintings we cannot understand why they are so valuable. Here is a list of these paintings you may think you can do yourself.

Keep Reading

Becoming a Dana Group Employee – Up to ₦236,000 as average salary!

Dana Group is an amazing place to work since it has so many options. Surely there must be one that fits you!

Keep Reading

Applying at Kohl’s – $30,490 per year on average!

If you want to learn more about the application process at Kohl's, make sure to check out our article for further information!

Keep ReadingYou may also like

Belgotex worker review!

Belgotex is an amazing place where you can grow not only financially, but as a person too. Check out our full review!

Keep Reading

Apply at FMN – Up to ₦148,498 monthly!

If you are looking to learn what are the skills to excel, and how you can understand the application process to prepare, this post might help!

Keep Reading

Become a security officer – Earn R5,542 per month on average!

If you need a job that gives you flexibility and good pay, you should learn how to become a security officer!

Keep Reading