Finance

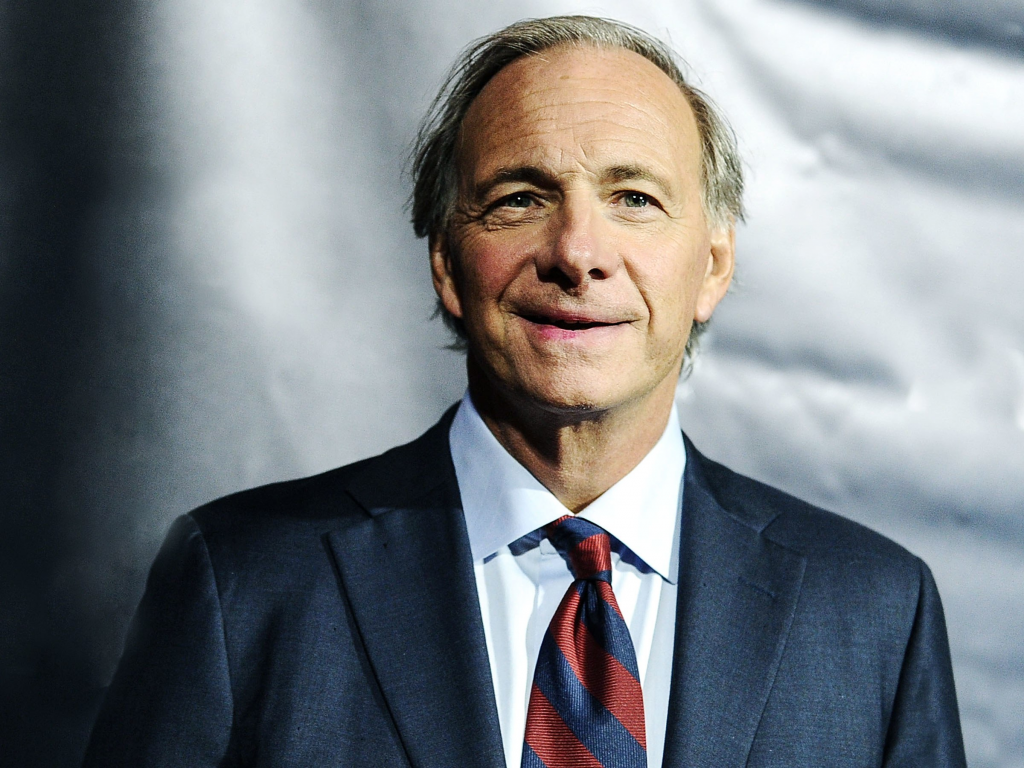

These are some stocks that Ray Dalio has been betting on

Legendary Ray Dalio has some stocks and ETFs up his sleeve. check out in this article some of the options that he has.

Advertisement

With more than $150 billion in assets, Bridgewater Associates, run by Ray Dalio, is the biggest hedge fund in the world.

According to Forbes, Dalio has a personal net worth of around $22 billion. In 2020’s erratic market fluctuations, Bridgewater’s well-known Pure Alpha II fund underperformed and ended the year with a 12.6% loss.

Though the market has been lackluster in 2022, Dalio and the Pure Alpha II fund have prospered, generating an incredibly astounding 32% gain for the first half of the year.

Today, we are going to be taking a look at some stocks that Mr. Dalio is betting on.

These stocks have generated good and steady income

If you are looking for that kind of buy-and-hold-forever kind of stock, look no further. These are some of the steadiest stocks.

Recommended content

Procter & Gamble

Blue-chip consumer goods business Procter & Gamble is the proprietor of well-known brands like Pampers, Tide, and Bounty. It also represents Bridgewater’s single-largest stock investment.

Through August 22, PG shares had produced a total year-to-date loss of 7.1%, barely outperforming the S&P 500. During times of market turbulence and uncertainty, consumer staples stocks like Procter & Gamble are seen to make good defensive investments.

In the most recent quarter, Procter reported a 3% increase in revenue and a 5% increase in net income. 6.74 million shares of PG stock, valued at $970 million, are held by Bridgewater.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

iShares Core MSCI Emerging Markets ETF

For Dalio to continue to defend some of his biggest Chinese investments, it appears that the risks brought on by Chinese and American regulatory crackdowns and threats to delist Chinese companies have just gotten to be too great.

Bridgewater sold out all of its holdings in the Chinese companies NetEase Inc., JD.com Inc., Bilibili Inc., and Alibaba Group Holding Ltd. in the second quarter (NTES).

Instead, Dalio seems to be approaching China more diversified through the IEMG fund, an exchange-traded fund for emerging markets that are only slightly over 25% exposed to China.

15.3 million shares of the IEMG fund, valued at $751 million, are held by Bridgewater.

Coca Cola

Coca-Cola is another premium consumer staples stock that makes a great defensive investment in a volatile market.

Through August 23 of 2022, Coca-Cola shares have produced a year-to-date total return of 10%, demonstrating their durability in a challenging environment. Coca-Cola reported 11.8% revenue growth and $1.91 billion in net profits for the most recent quarter.

Warren Buffett, a fellow billionaire and the CEO of Berkshire Hathaway Inc. (BRK.A, BRK.B), has also made Coca-Cola one of his top long-term holdings, placing Dalio in an excellent company.

Bridgewater currently owns around 10.82 million KO shares, valued at $680 million.

PepsiCo

Rarely does Dalio put his entire financial future in one basket. Another one of the major holdings in the fund, in addition to his sizeable interest in Coca-Cola, is rival PepsiCo.

Unfortunately, PEP shares haven’t performed as well as Coca-Cola shares thus far in 2022, but they’ve still been a rather strong performer in a bear market, delivering a total return of 4.1% year to date through August 22.

PepsiCo reported a revenue increase of 5.2% and a net income of $1.43 billion for the most recent quarter.

Bridgewater currently owns around 3.8 million PEP shares, valued at $635 million.

Costco Wholesale Corp.

Costco reported a same-store sales increase of 10.8% for the fiscal third quarter in May, and its subsequent monthly updates imply that sales growth has continued robust throughout the summer.

Although the price of Costco stock, which currently trades at 38 times estimated future earnings, isn’t exactly low, Dalio probably recognizes the advantages of the company’s double-digit revenue growth over rivals like Walmart Inc. (WMT) and Target Corp. (TGT).

In the second quarter, Dalio increased Bridgewater’s ownership of Costco by 23,331 shares. Approximately 1.21 million shares of COST stock, worth $580 million, are now held by the company.

Trending Topics

How to apply for Woolworths Black Credit Card!

If you are looking to have an excellent premium card, learn how to apply for a Woolworths Black Credit Card here!

Keep Reading

Atlas Finance Payday Loans full review!

Atlas Finance is one of the most experienced financial players in the landscape, which means you will have experience on your side!

Keep Reading

Applying at Schlumberger – ₦ 500,000 per month in the beginning!

If you are looking for an article that can help you improve the odds of getting a job at Schlumberger, look no further.

Keep ReadingYou may also like

Becoming an Alexander Forbes Employee – R 303 487 a year as a possible salary!

Alexander Forbes is a financial institution with a lot of history, and very solid. This means a lot if you want a job there!

Keep Reading

Applying for a loan at GTBank – Up to ₦50,000,000 in personal loans!

If you are looking for a guide to help you with the application process for a personal loan at GTBank, this one might help you out!

Keep Reading

BKB worker full review!

BKB is a very renowned company in the agricultural and auctioneer business, and provides an excellent place for development!

Keep Reading