Credit Card

Nedbank Small Business Credit Card full review!

If you have a small business and want to have a big bank's help to get credit and other opportunities, check this out!

Advertisement

If you are in the beginning, ensure this giant can help you!

Having the appropriate financial instruments at your disposal may make a huge difference in the dynamic world of entrepreneurship and business.

Enter the Nedbank Small Business Credit Card—a specialized tool painstakingly designed to support single proprietors, SMEs, and startups on their path to success.

We shall learn about the variety of features and perks that make this credit card unique as we continue reading through this in-depth study.

This review seeks to provide you with a thorough grasp of how the Nedbank Small Company Credit Card can be a reliable ally for your company goals, from flexible repayment choices to interest-free credit periods to business benefits to the ease of digital banking.

Recommended content

How does the card work?

Business owners benefit from a revolving facility with the Nedbank Small Business Credit Card that enables them to pay only the minimal amount due, improving cash flow and working capital.

The card offers flexibility in how costs and payments are handled by allowing up to 55 days of interest-free credit.

Also, the Greenbacks Rewards Program, which enables cardholders to earn rewards while doing business-related activities, is one of the notable features.

Spending with a credit card can generate rewards, which can lead to cost savings or other advantages.

Even though the Nedbank Small Business Credit Card has several advantages, it’s necessary to take into account the costs. The card includes an introductory charge of R262 and a monthly service fee of R57. The credit profile affects interest rates.

A 5% discount on AVIS SME rates, goods purchase protection, double Greenbacks points on American Express Card spend, free access to Bidvest lounges, and automatic basic travel insurance with top-up possibilities are just a few of the card’s additional business-specific benefits.

The Nedbank Small Business Credit Card, which provides credit flexibility, incentives, and practical digital banking services, acts as a financial ally for companies. Potential candidates should carefully consider the terms, conditions, and related costs before applying, just as with any other financial product.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

What are the main benefits of the card?

- Credit that is Personalized to Your Needs and Affordability: The card offers credit that is Personalized to Your Needs and Affordability, Aiding You in Efficiently Managing Cash Flow and Working Capital.

- Revolving Facility: You have freedom in how you manage your payments since you just have to make the minimum payment due each month.

- Interest-Free Credit: Take advantage of up to 55 days of interest-free credit to make purchases without being charged interest right away.

- Three flexible repayment choices are available: budget financing, full payment with up to 55 days of interest-free periods, and minimum 5% monthly repayments.

- Benefit from a 5% discount on AVIS SME and Daily rates, purchase insurance for undelivered products, and double Greenbacks benefits on American Express Card spending with the business rewards program.

- Greenbacks earnings: With the Greenbacks Rewards Program, swipe to collect points and maximize your earnings with each purchase.

What are the potential drawbacks of the card?

- Fees: The credit card has an initial cost and a monthly service fee that might increase your business expenses, particularly if you run a small firm with little cash flow.

- Interest Rates: The interest rates on the card might change depending on your credit history. If you carry a balance from month to month, high interest rates might result in hefty charges.

- Limited to Businesses: If you’re searching for a personal credit card, you’ll need to check into other choices as this credit card is only meant for business usage.

- Minimum Turnover Requirement: Your company must achieve a minimum yearly turnover requirement of R150,000 in order to be eligible for the Nedbank Small Business Credit Card. This may not apply to startups or extremely tiny firms.

Wanna learn how to apply?

If you got interested and understood that this card might be a good option for your business, make sure to take a look at our next article.

There, we are going to discuss all the requirements and the application process for the Nedbank small business credit card!

Trending Topics

7-Eleven Worker review – $26,000 per year for entry-level positions!

If you are looking for a job position at 7-Eleven, but want to learn more before committing to this decision, check it out!

Keep Reading

African Bank Personal Loan full review!

African Bank has the flexibility of payment and rates that you may need, as well as an online application. Check it out!

Keep Reading

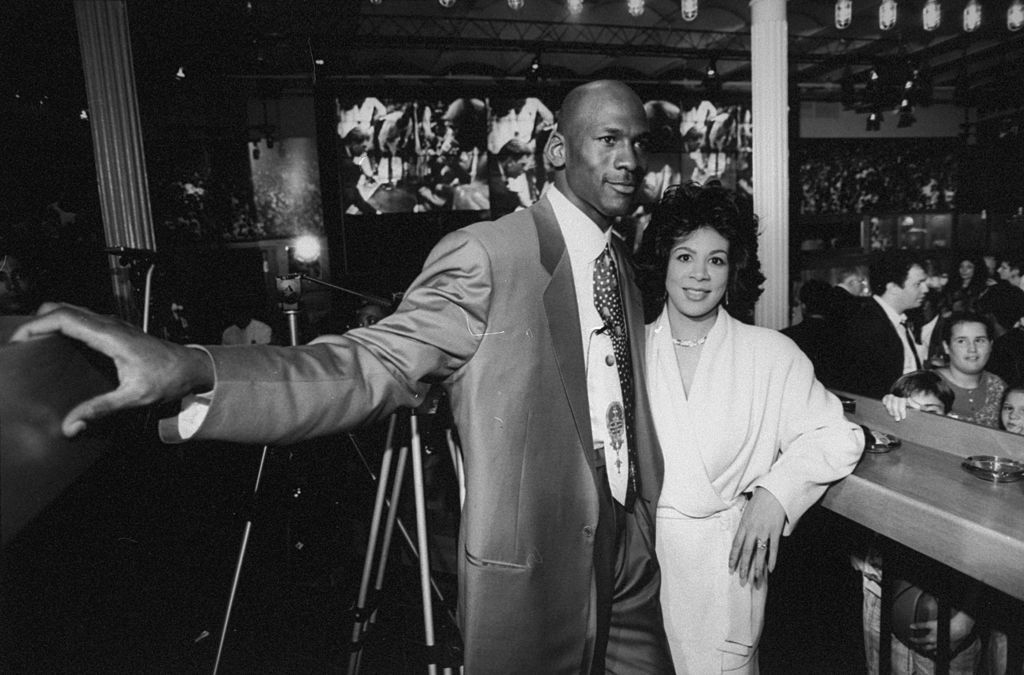

Jordan’s Divorce Settlement Makes History

The highest amount paid by a celebrity in a divorce settlement until that year - $168 million. However, Jordan learned his lesson.

Keep ReadingYou may also like

Is it better to rent or to own your job?

To invest or not to invest? Is it better to make a business of my own? I share with you my vision about this matter.

Keep Reading

How to apply for the Absa Bank Premium Banking Credit Card!

If you are here to learn all the ins and outs of the application process about this card, grab a seat and read closely!

Keep Reading

Nedbank Gold Credit Card Full review!

If you are a person that wants a credit card with many benefits and discounts, make sure to read our review and see if this one fits you!

Keep Reading