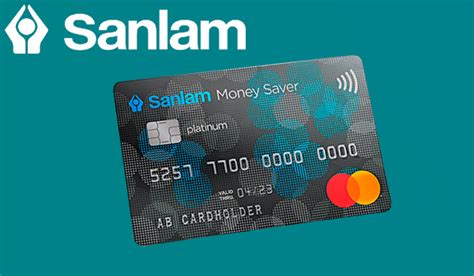

The Sanlam Money Saver Credit Card might be a good option for you!

Sanlam Money Saver - Build credit score and save money!

Advertisement

With the Sanlam Money Saver Credit Card, you may transform your financial approach by combining saving and spending in a revolutionary way. With the exception of TotalEnergies forecourts, discover the power of automated rewards—up to 5% Wealth Bonus per swipe. This card fits your lifestyle with its variable interest rates, small monthly charge of R56, and interest-free period of up to 55 days.

With the Sanlam Money Saver Credit Card, you may transform your financial approach by combining saving and spending in a revolutionary way. With the exception of TotalEnergies forecourts, discover the power of automated rewards—up to 5% Wealth Bonus per swipe. This card fits your lifestyle with its variable interest rates, small monthly charge of R56, and interest-free period of up to 55 days.

You will remain in the same website

Select the non-co-savings option with 3% incentives or the co-savings path for matched contributions. This credit card encourages sound financial management, whether for anticipated or unforeseen costs. Become a member today to gain access to a world where your purchases create wealth in addition to making life easier. Make sure to check out our articles on how to apply and a full review if you want to have even more information about the card!

You will remain in the same website

People in South Africa who are 18 years of age or older and earn R3,000.00 or more per month, regardless of whether they work full-time, have a contract that is active for at least a year, or are self-employed.

With every transaction, you pledge to add 2.5% to a special Wealth Bonus account as part of a special feature called Wealth Bonus. With Sanlam matching your contribution, every swipe earns you a total of 5% Wealth Bonus (not at TotalEnergies forecourts).

There are two variants of the Sanlam Money Saver Credit Card available: one with co-savings and the other without. Sanlam matches your contributions if you have co-savings; if not, you still receive rewards, albeit at a reduced rate.

Yes, there is an initiation cost of R165.00 and a monthly service charge of R56.00 for the credit card. These charges apply only to the credit card.

Your savings are increased when you use your card at partner stores like Total, Adidas, Dischem, and more because you get extra benefits called Wealth Bonus.

If you are looking for a more opulent card, for a person who has more income, and with that, different needs, make sure to take a look at the Discovery Bank Black Credit Card.

Issued by Discovery, you will have access to an amazing rewards system alongside some incredible dynamic rates that fit your needs. Check it out!

Discovery Bank Black Credit Card full review!

Discovery Bank is known to have very good rewards and a very unique rewards system, with this card, you get the best of this world!

Trending Topics

Applying at Blaze Pizza – $23,000 per year can be your salary!

Looking for an opportunity at Blaze Pizza? Check out more about the application process and what soft skills you can showcase to excel!

Keep Reading

Applying for a personal loan at Sterling Bank -You can borrow up to ₦5,000,000

If you are looking for an article to help you with the application process at Sterling Bank, this might be the one for you!

Keep Reading

The life of an Amazon delivery worker

Being one the leading companies in the world, Amazon has many employers. How is the life of a delivery worker? Check out now!

Keep ReadingYou may also like

Standard Bank Titanium Credit Card Review

This card from Standard Bank is one of the most popular in the country, and it's a good option if you are looking to save some money!

Keep Reading

Firehouse subs worker review – $39,783 per year as an average salary!

Firehouse Subs offer an excellent work environment alongside excellent perks, especially for entry-level positions. Take a look!

Keep Reading

Curiosities about the human body you probably didn’t know

I would like to invite you to reflect on how we are such complex beings. Let's learn a little more about our bodies.

Keep Reading