Credit Card

Nedbank Business Credit Card full review!

If your business is already on the right track, and you want it to have even more positive results, this card might help you out!

Advertisement

Interest-Free Transactions and a lot of help from many platforms!

Having the appropriate financial instruments is crucial in the modern corporate world. Enter the Nedbank Business Credit Card, a potent tool painstakingly created to provide established businesses with rewards and financial freedom.

In this thorough evaluation, we examine every nuance of the Nedbank Business Credit Card, covering its attributes, advantages, potential downsides, and special value.

Join us as we analyze this financial tool, reveal its secrets, and assist you in making an informed choice for the financial future of your firm, whether you are a booming enterprise or an experienced entrepreneur.

Recommended content

How does the Nedbank Business Credit Card work?

The Nedbank Business Credit Card offers a variety of features and perks to improve financial management and flexibility as a personalized financial solution for established enterprises in South Africa.

The card’s interest-free settlement system is one of its distinguishing qualities. Businesses can completely avoid paying interest by making sure their credit card amount is paid off each month.

This novel strategy promotes prudent money management and does away with the cost of interest payments.

Additionally, the card has a dual-issued American Express card that enables customers to conveniently utilize different ATMs and point-of-sale terminals at Nedbank and other banks as well as their own.

Nedbank’s dedication to assisting businesses is clear from the useful resources it offers. The Essential Guide for Small Business Owners provides useful advice on managing a prosperous company.

Additionally, an online platform called Avo Services lets companies advertise and sell their goods to a large audience of more than one million registered users.

Although the Nedbank Business Credit Card has several benefits, it’s crucial to be aware of any additional costs. The card has an R420.00 initial cost and an R420.00 yearly fee.

The Greenbacks rewards program has an extra R588.00 fee for enrollment. Fees may also apply to some actions, including balance checks, ATM withdrawals, and statement requests.

The Nedbank Business Credit Card essentially offers established firms a complete range of financial capabilities. The card promises to improve the financial health and efficiency of businesses by encouraging responsible financial behavior and providing practical digital banking solutions, rewards programs, and tools.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

What are the benefits of applying for this card?

- Interest-Free Transactions: If you pay off the entire balance on your card each month, you can benefit from interest-free transactions. This function reduces wasteful spending and improves cash flow.

- Earn twice as many points by joining the Greenbacks rewards program and using your American Express card. Earn rewards quickly to maximize the value of your commercial dealings.

- Flexible Card Issuance: Several cards may be issued under the business account, allowing for effective management by staff members who make purchases on the company’s behalf.

- Utilize Avo Services’ large sales platform, which has more than one million registered users. Showcase your goods and services to a wider audience to increase your market reach and growth possibilities.

- Access to SimplyBiz: Sign up for SimplyBiz, a networking and resource platform designed solely for company owners and entrepreneurs. Make connections with colleagues, exchange ideas, and gain access to helpful tools to improve your business tactics.

What are the possible drawbacks of this credit card?

- Enrollment Fees: Businesses must pay a one-time enrollment fee of R588.00 in order to access the Greenbacks rewards program, which offers double points on American Express Card purchases. Some organizations could be put off by this up-front investment, particularly those looking to cut costs at the beginning.

- A one-time startup charge of R420.00 is associated with the card. Although this fee is only charged once, it increases the upfront cost of getting the card.

- Interest-Free Requirement: Although the interest-free settlement method benefits responsible enterprises, it could be difficult for those who experience erratic cash flows or sporadic cash flow problems.

Wanna learn how to apply?

If you want to learn how to apply for the card, make sure to take a look at our next article!

There, you are going to understand all the requirements of the card as well as the application process.

Trending Topics

The stocks Bill Gates uses to generate a lot of income

Even a tech billionaire can use the stock market in his favor. Check out these stocks Bill Gates is using to generate income for him.

Keep Reading

Applying at NPA – ₦140,000 per month for those who are starting!

If you are looking for a job that gives you stability and prestige amongst your friends, NPA is a good option to apply for!

Keep Reading

Applying at Jiffy Lube – $32,314 per year can be your salary!

If you want to apply at Jiffy Lube and want to get all the information you can to improve your odds, perhaps this article is the one for you!

Keep ReadingYou may also like

The Best Apps for Buying Airline Tickets

Next destination: good deal! Here is a list of the best apps you can use in order to find airline tickets at the best prices!

Keep Reading

Applying for a course about learning Go

Golang is a fantastic skill to learn, and if you want to apply for a course that teaches you how to use it, keep reading!

Keep Reading

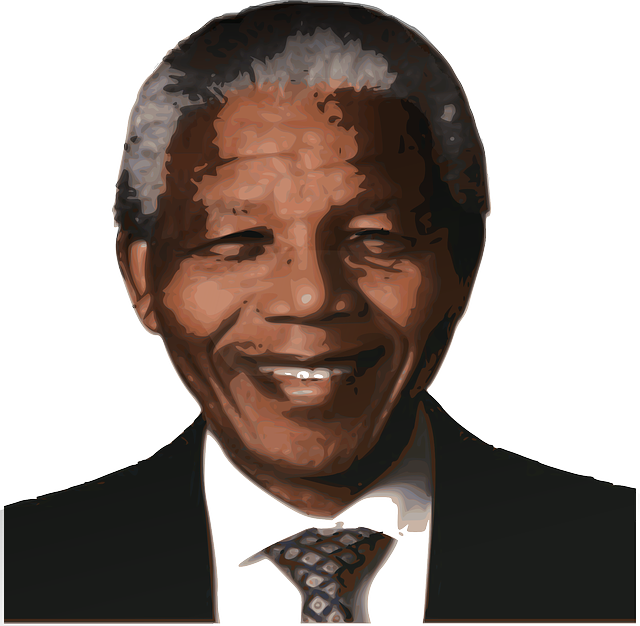

Mandela’s Hidden Legacy: 5 Lesser-Known Stories from South Africa’s Hero

Discover 5 lesser-known stories about South Africa's hero, Nelson Mandela. From his love for gardening to playing saxofone.

Keep Reading