Finance

How To Avoid Marriage-Ending Money Issues

Find out some very important tips for those who want to avoid marriage-ending money issues, and therefore want to build a lasting relationship.

Advertisement

Recommended content

Introduction

We all know that money can be the solution for many of our problems or the cause of a lot of our demises (especially the lack of it).

When it comes to couples, money issues can become the cause of serious relationship discussions or even worse, a divorce.

In order to help your relationship, and avoid marriage-ending issues, we will discuss many common money discussions between a couple, and what are the best ways to make sure that these problems will be solved in the best way possible.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

Define what’s mine, yours, and ours

Many couples think that the best way to avoid money-related issues is to simply split the bills in half and each spouse is responsible for the money they gain. Putting it simply: “there is no such thing as our money, there is your money and my money”. Well, in theory, this helps a lot, but in real life…

The biggest problem this kind of approach brings is the one related to ego. Say that one spouse gains substantially more than the other, but only because the other spouse is responsible for the house, the kids, and any other problem related to the home.

See, it’s not that one spouse works more than the other, simply their obligations are different. In this situation, if the money is “ours”, it creates complicity. However, if the money is “mine and yours”, it creates resentment and ego problems.

Define a “same goal” for the couple.

Now you understand that the money needs to be the couples’, not separated, to avoid marriage-ending money issues. It’s likewise important that both spouses have the exact same goal related to money, in order to avoid a major disaster.

As time goes by, it is natural that different people have different priorities and because of this, different goals. Like in many relationships, communication is key, but if the spouses don’t sit once and awhile to realign themselves, things can go really bad really fast.

So, in order to avoid this situation, it’s advisable to sit once every six months, so the spouses can decide what is “the couple’s goal”. Like the previous tip, this one relies not only in good and healthy communication but also on building a lasting relationship based on confidence and unity

Don’t forget the household budget.

Building a budget may seem tedious and boring, and in fact, sometimes it is. But that’s not an excuse to underestimate one of the most important tools for a healthy financial situation. Not only this can define the couple’s good financial situation, but the marital situation as well.

By doing a household budget, the spouses will be able to understand very well where the money they earn is going, not only that, but understanding how much the couple spends on average can drastically decrease the amount of discussion, but not only that, improve the financial health of the family.

Despite the fact that making a household budget may seem boring, there are a lot of software that may help the couple in their quest to make their budget. A prevalent example is the program Mint, many advisors strongly recommend it, so it’s worth the shot.

Conclusion

Marriage is not an easy task, discussions will always occur. What we must avoid are the discussions that can be marriage-killers.

Rest assured, however, that if you keep your communication with your spouse transparent, and the money track on check, you can be sure that there will be no problem that you cannot pass through. Not only that but most importantly, together, as a couple.

Trending Topics

Rite Aid worker review – $31,200 per year as an average salary!

Do you want to learn more about Rite Aid and the job conditions? This article might have all the information you're gonna need!

Keep Reading

How to apply for an Absa Bank Personal Loan!

Take a look at this article if we are in need for a personal loan and wants to apply at Absa Bank. Their conditions are awesome!

Keep Reading

The Dark Side of South African History: 6 Bone-Chilling Tales You’ve Never Heard

Uncover the chilling and lesser-known stories from South Africa's dark history with this 6 bone-chilling tales.

Keep ReadingYou may also like

Jaws on the Shore: South Africa’s Most Terrifying Shark Encounters

A thrilling exploration of terrifying shark encounters: delve into the intrigue of these true South Africa's scariest experiences.

Keep Reading

Apply to work at Ford – Where annual wages might range from R 105 000 to R 500 000!

Ford is a well established company for more than a century. Learn all you need to know in order to apply to work with them!

Keep Reading

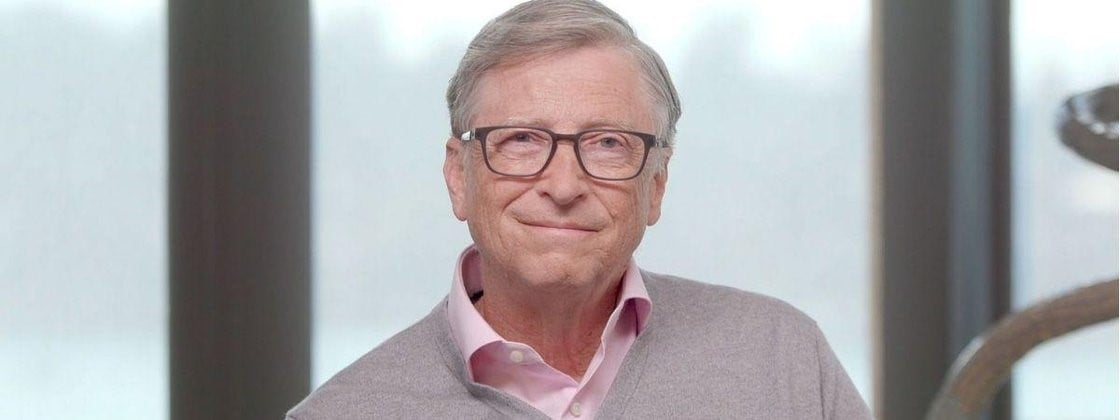

The stocks Bill Gates uses to generate a lot of income

Even a tech billionaire can use the stock market in his favor. Check out these stocks Bill Gates is using to generate income for him.

Keep Reading