Credit Card

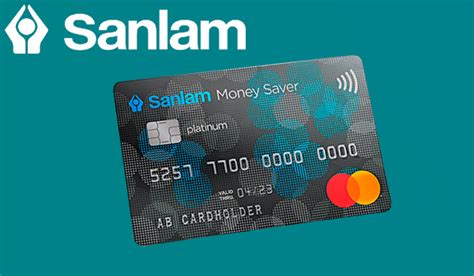

How to apply for the Sanlam Money Saver Credit Card!

If you are looking for an article that can explain what you need to apply for this amazing card, look no further, and start reading this one!

Advertisement

What do I need to know?

The Sanlam Money Saver Credit Card can be the best option for you if you’re looking for a credit card that not only provides you with financial flexibility but also makes every transaction cost less.

This special credit card combines ease of use with the ability to accumulate wealth, making it a compelling choice for individuals who want to get the most out of their money. We’ll guide you through the steps to get this cutting-edge card.

This guide will provide you with the information you need to handle the application process with ease and make wise choices about combining the benefits of credit and savings, regardless of your level of experience with credit cards.

Who can apply?

The Sanlam Money Saver Credit Card is intended for a particular group of people who satisfy certain requirements.

Generally speaking, anyone living in South Africa who is at least eighteen years old and makes at least R3,000.00 per month is qualified to apply for this credit card. For most applicants, a contract lasting 12 months or more, or permanent employment, is necessary.

Furthermore, self-employed people might also be qualified; however, they might need to submit more documentation with their application.

To make sure you meet the requirements for the Sanlam Money Saver Credit Card, it’s crucial to check the eligibility conditions listed by Sanlam before applying.

You will be redirected to another website

What is the application process at Sanlam?

The Sanlam Money Saver Credit Card application process is easy to use and is made to make it simple to take advantage of its features.

Gathering the necessary paperwork is the first step. You’ll need a current South African ID, evidence of income (like a payslip), and a three-month bank statement showing salary deposits.

After all of your paperwork is in order, visit the Sanlam official website and find the Sanlam Money Saver Credit Card section. This is where the online application form is located.

Complete the form completely, providing accurate information about your name, contact details, employment data, and income.

Once the application has been carefully filled out, check the entered data for accuracy. After you’re pleased, use the offered web platform to electronically submit the application.

After that, your application will be thoroughly reviewed by the Sanlam staff.

Although the evaluation and approval procedure could take some time, you should be able to expect a response in a reasonable amount of time. You will receive confirmation by email or other preferred communication means you have specified if your application is accepted.

This confirmation usually contains important details regarding your recently obtained Sanlam Money Saver credit card.

Your authorized credit card will be processed and shipped to your registered address once the confirmation has been received. It’s a good idea to monitor your email or other assigned communication channels for any messages or updates about the status of your application.

Even if the procedures are the same, it’s always advisable to check the official Sanlam website or contact customer service to get the most up-to-date and precise details about applying for the Sanlam Money Saver Credit Card.

Wanna look at another option?

Check out the Discovery Bank Black Credit Card if you’re searching for a more luxurious card for someone with more income and therefore different needs.

Issued by Discovery, you will be able to take advantage of some wonderful dynamic rates that suit your demands, in addition to an exceptional rewards system. Look it over!

Discovery Bank Black Credit Card full review!

Discovery Bank is known to have very good rewards and a very unique rewards system, with this card, you get the best of this world!

Trending Topics

Tips on how to choose a stock that fits you

If are you looking for investing in a stock, but don't know how to choose the one that is perfect for you, check out this guide!

Keep Reading

Applying for a Search Engine Marketing Course!

Take a look at this article if you want to make your first step into the wonderful world of SEM (Search Engine Marketing)

Keep Reading

The rise of 5G: how it affects the way you navigate on the internet

Our internet connection is about to get better! Check out this article about how 5G might be the beginning of a new revolution.

Keep ReadingYou may also like

Why is it important to have insurance?

Insurance is considered by many people some kind of cost that is unnecessary, which is not correct. Check out why insurance is crucial.

Keep Reading

Applying at Blaze Pizza – $23,000 per year can be your salary!

Looking for an opportunity at Blaze Pizza? Check out more about the application process and what soft skills you can showcase to excel!

Keep Reading

Applying at Eat’n’Go – ₦ 138,000 as average for some entry-level jobs!

If you need a good entry-level job with excellent benefits and space for development, check out Eat'n'Go and its application process!

Keep Reading