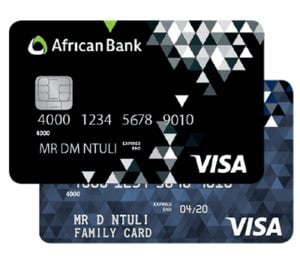

Credit Card

How to apply for the African Bank Credit Card?

If you want to learn how to apply for this very good credit card and enjoy all its benefits, make sure to check this article!

Advertisement

What do I need in order to apply?

A crucial step in determining the course of your financial life is navigating the credit card application procedure. If you’re thinking about getting an African Bank credit card, this tutorial will show you how to go about getting this useful financial tool.

The African Bank Credit Card offers ease, security, and adaptability to meet a range of demands and lifestyles. This thorough article will outline the procedures needed to successfully apply for an African Bank credit card, giving you all the knowledge you need to make an informed choice.

This guide is designed to walk you through the whole application process, whether you’re looking for a simplified digital application procedure or want to understand the eligibility requirements, costs, and documentation.

Who can apply?

A valid South African ID or permanent residency card, along with a person’s age, qualifies them to apply for the African Bank Credit Card.

Also, a wide range of candidates, including those who are working and self-employed, are eligible for this credit card.

The eligibility requirements, however, go beyond age and place of residence. Additionally, applicants are required to submit proof of income, which is often a recent bank statement showing at least three months’ worth of wage deposits.

This stipulation guarantees that applicants have a steady stream of income that they can depend on to handle credit card transactions appropriately. It’s important to remember that the application procedure takes creditworthiness and affordability into account.

You will be redirected to another website

How is the application process for this credit card?

The bank’s official website can be used to complete the simple and convenient application process for an African Bank credit card. The user-friendly online application will walk applicants through the process step by step.

Visit the African Bank website and look for the part that is specifically for credit card applications to start the application process.

Sharing information about your income, such as your employment status, job title, and monthly salary, is the next step.

You can select the precise African Bank credit card throughout the application process that best meets your requirements. You can be asked to specify your preferred credit limit, depending on your preferences and financial position.

You can be required to upload necessary records during the procedure, including evidence of identification, residency documentation, and bank statements.

These records are essential for confirming your identification and financial security.

Following the submission of your application, African Bank will evaluate your credit. To ensure appropriate lending practices, this review takes into account a number of variables, including your credit history and affordability.

African Bank will send you an email or use another mode of communication to let you know if your application has been approved after the evaluation is finished.

After that, you may choose to have your personalized embossed African Bank credit card shipped to your registered address or issued quickly at any African Bank branch.

Before submitting your application, it is crucial to read the credit card’s terms and conditions. Additionally, having a thorough understanding of any applicable fees and charges can aid in your decision-making during the application procedure.

Wanna look at another card?

Before making a decision, be sure to look into the Sanlam Money Saver Credit Card if you want more possibilities for a decent credit card.

Make sure to look at this fantastic choice if you’re looking for an excellent card to raise your credit score, save money, and get rewards. Look it up!

Sanlam Money Saver Credit Card Full review!

With a very good, yet simple rewards system alongside with flexible rates and different account options. Take a look!

Trending Topics

Finchoice Personal Loans full review

Finchoice is an excellent lender if you need money for any emergency, allied with a quick application and good support!

Keep Reading

Why you should for a course about Big Data Integration and processing

Learning how to use Big Data is essential if you are willing to keep improving and learning the important skills of the future.

Keep Reading

Apps for writing: check these out!

A so much used art that became banalized, but it shouldn't be. Check out some apps if you want to be a better writer!

Keep ReadingYou may also like

Becoming a British American Tobacco employee – Up to ₦ 212,353 per month depending on the role!

BAT is a market leader whose benefits packages and salary is made to retain talents. Keep reading to learn more!

Keep Reading

PepsiCo worker review

PepsiCo is one of the leading companies on beverages, but not only that! Check out our full review on how it is to work with them.

Keep Reading

Applying at Stanbic IBTC – ₦107,000 per month can become your salary!

If you are looking for an exceptional place to work, make sure to check out our article on how to apply at Stanbic IBTC!

Keep Reading