Loans

Hoopla Personal Loans full review

Hoopla is an online platform that is known for being simple and getting you in touch with many lenders. Check it out!

Advertisement

Up to R 250,000 in personal loans!

Finding a reliable and effective loan source might be difficult. Here, Hoopla Loans steps in, providing a complete online platform that links borrowers with a network of South African lenders with the necessary licenses.

Hoopla Loans makes the application process for personal loans easier, ensuring a secure, speedy, and trouble-free experience. In this in-depth review, we delve into the features and advantages of Hoopla Personal Loans.

You can learn a lot about how Hoopla Loans can meet your financial demands by exploring the nuances of this reliable loan-matching service.

So, let’s jump in and dive deep into our full review so you can check out all that is important!

Who are Hoopla Loans?

A well-known internet platform and loan matching business operating in South Africa is called Hoopla Loans.

Since it was founded in 2018, the business has quickly built a reputation for itself by giving customers a secure, practical, and quick means to contact a panel of National Credit Regulator (NCR)-registered lenders.

Hoopla Loans has built a solid reputation by placing a priority on client happiness and claiming an 84% loan approval rate.

The lender serves as a middleman between borrowers and respectable lenders who are registered with the NCR in its capacity as a loan broker.

Their main goal is to make the loan application procedure as simple as possible while still allowing borrowers to choose from a wide range of loans that are tailored to their individual requirements.

Hoopla Loans assists people in obtaining personal loans, payday loans, short-term loans, and even debt consolidation loans by utilizing their wide network of lenders.

You will be redirected to another website

How do Hoopla personal loans work?

Hoopla Loans connects consumers with a network of authorized lenders and streamlines the loan application process using a user-friendly platform.

People can go to the Hoopla Loans website and submit an online application to be considered for a Hoopla Personal Loan.

Standard personal and financial information needed for this form includes identification information, income documentation, and proof of address.

Following submission of the application, Hoopla Loans examines the data supplied and links the applicant with relevant lenders from their network.

Depending on the borrower’s profile and lending requirements, these lenders then review the application and provide loan offers.

The borrower is free to contrast different loan offers, taking into account things like interest rates, costs, loan periods, and monthly payback sums.

This enables customers to select the solution that most closely matches their preferences and needs in terms of money.

The borrower then signs the loan agreement after deciding on a loan offer.

After that, the authorized loan amount is then electronically placed into their bank account, giving them the money they require to meet their responsibilities or achieve their objectives.

Additionally, the protection of borrower information is a top priority for Hoopla Loans throughout the whole process.

To guarantee the privacy and security of the personal information provided during the application process, their website is outfitted with encryption technology.

What are the benefits of applying for a loan at Hoopla?

- Access to a Variety of Lenders: Hoopla Loans serves as a broker, putting you in touch with a group of dependable South African lenders.

- Streamlined Loan Application Process: Hoopla Loans has made the loan application process simple and speedy. You can quickly fill out an application form using their web platform from a computer or mobile device. The procedure is simple, and you can anticipate receiving a response to your application the same day.

- Competitive Interest Rates: Hoopla Loans assists you in obtaining the most affordable interest rates on the market by coordinating with several lenders.

- Flexible lending options: Hoopla Loans provides a range of lending products, such as personal loans, payday loans, short-term loans, and debt consolidation loans.

Want to learn how to apply?

If you’re interested, check out our “How to Apply” article.

There, we are going to discuss what you need to apply for a loan at Hoopla as well as how the application process usually works.

Trending Topics

Applying for a personal loan at Stanbic IBTC – ₦4,000,000 in Personal Loans!

If you are looking for an article that can give you the step by step on how to apply for Stanbic IBTC, than check this one out!

Keep Reading

Applying at PepsiCo – With an average salary of $85,541 per year!

See the step-by-step into how to apply for PepsiCo and also, what skills you need to have to excel as an employee!

Keep Reading

Apply at BKB – Job security and Development opportunities!

If you want to apply to a company that has a lot of history and can help you develop your career, check out BKB Limited!

Keep ReadingYou may also like

Hoopla Loans payday loans full review!

Hoopla is a platform where you can compare many offers by many lenders, so you can choose the best one for you in just one place!

Keep Reading

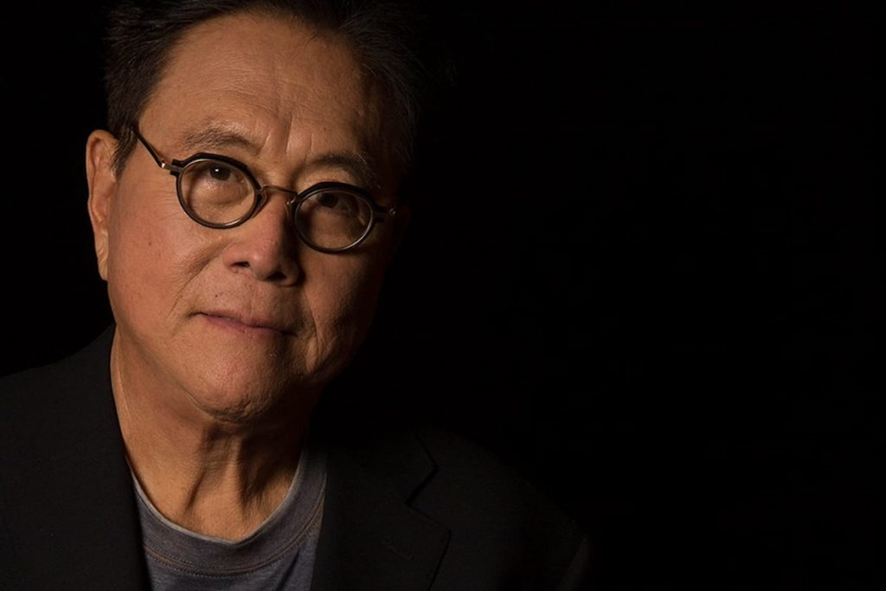

Things ‘Rich Dad, Poor Dad’ gets wrong

Some considered it a "classic" for good reasons, but some statements don't seem quite right or are outdated. Find out some of them.

Keep Reading

Becoming a Toys R Us employee – R 234 067 is the average salary

Toys R Us is an amazing company not only for those who love children and dreams but for the people who want to improve themselves!

Keep Reading