Finanzas

Las técnicas de Warren Buffett de las que nadie habla

El mejor inversor de todos los tiempos debe tener algunos trucos bajo la manga, y de hecho los tiene. Eche un vistazo a estas técnicas.

Anuncios

Uno de los inversores más reconocidos y exitosos de todos los tiempos es Warren Buffett.

Cuando empezó a comprar acciones de Berkshire Hathaway a $7,60 por acción, a sus 30 años, había estado invirtiendo en acciones desde que tenía 10 años y había amasado un millón de dólares.

Berkshire cotiza actualmente alrededor de $400.000, mientras que Buffett vale $97 mil millones.

Buffett es famoso por su estrategia de comprar porciones importantes de empresas de primera línea con perspectivas infravaloradas y una gestión capaz. Conserva esas acciones durante años o quizás décadas después de eso. Atribuye su logro a la adhesión a dos reglas:

La primera regla es no perder nunca dinero. No olvides nunca la regla nº 1 (regla nº 2).

Sin embargo, hay algunas pequeñas acciones que Buffett lleva a cabo que pueden ayudarle a aumentar sus resultados. Vea algunas de ellas.

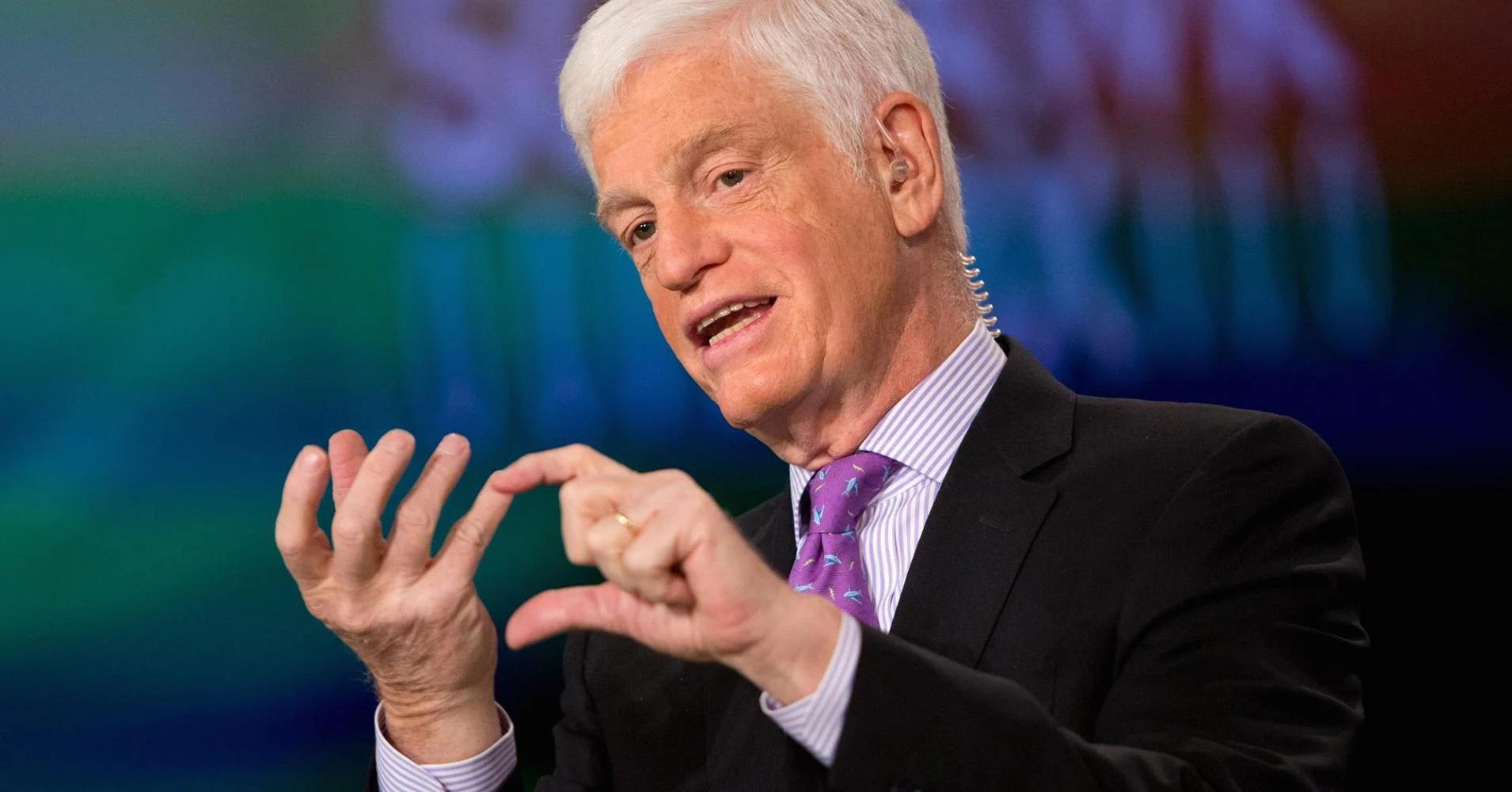

A Mario Gabelli le gustan estas acciones

El inversionista multimillonario Mario Gabelli compartió algunas opiniones sobre algunas acciones y una industria en particular en la que está invirtiendo. ¡Mira ahora!

Reducir pérdidas cuando sea necesario

La estrategia de “comprar y conservar” de Buffett no incluye nunca reconocer que incluso él comete errores.

Cuando empiezan a aparecer pérdidas en una empresa bien administrada, es una pista de que la economía del negocio puede haber cambiado de una manera que resultará en pérdidas durante un período muy largo.

El mayor error de Buffett fueron las empresas de aviación. Las cuatro principales aerolíneas estadounidenses (Delta, American Airlines, Southwest y United) estaban controladas originalmente por Berkshire Hathaway.

A finales de 2020, había abandonado todos los negocios que había añadido recientemente a su lista, con pérdidas.

Buffett reconoció su error, pero dejó claro que no veía futuro para el negocio de las aerolíneas, llegando incluso a referirse a él como un “pozo sin fondo”.

En ese momento, agregó, “no invertiremos en una empresa que, si pensamos, nos va a consumir dinero en el futuro”.

Invertir en acciones de pequeña capitalización

Adquirir acciones de empresas atractivas en ascenso no funcionará si estás gastando miles de millones de dólares en inversiones.

Si el Oráculo de Omaha hiciera una compra lo suficientemente sustancial como para que valiera la pena invertir su tiempo en ella, las acciones de empresas de pequeña capitalización con un valor típico de entre 300 y 2000 millones de dólares simplemente se moverían demasiado.

Al considerar sus alternativas de inversión, Buffett comentó una vez: “Tengo que buscar elefantes”. “Es posible que los insectos sean más atractivos que los elefantes. Pero ese es el mundo en el que tengo que vivir.

Las acciones muestran el crecimiento más rápido en las primeras etapas de la existencia de una empresa, lo que es una de las razones por las que esos supuestos “mosquitos” parecen atractivos.

Puede que a Buffett no le interesen esos vestidos diminutos, pero eso no significa que usted no pueda perseguirlos.

Venta de opciones de venta

Sería una tontería suponer que alguien como Buffett, que parece estar dedicado a las empresas de primera línea, evitaría los derivados complejos.

Buffett se ha beneficiado del sofisticado enfoque de negociación de opciones consistente en vender opciones de venta al descubierto como estrategia de cobertura durante toda su carrera como inversor.

De hecho, Berkshire Hathaway admitió en su informe anual de 2007 que tenía 94 contratos de derivados, cuyas primas totalizaron 1.400 millones de THB 7.700 millones para el año.

Este enfoque implica vender una opción que lo compromete a comprar eventualmente una acción a un precio de ejercicio establecido que es inferior a su valor actual.

Como resultado, usted recibe el pago inmediatamente cuando se vende la opción y conserva el dinero si el precio de la acción no disminuye.

Cuando usted compra acciones, paga menos de lo que hubiera pagado en el momento en que vendió la opción debido al efectivo proveniente de la venta de la opción, lo que reduce aún más su costo total si el precio cae por debajo del precio de ejercicio.

Debido a que comprarán las acciones a un precio inferior a su precio de ejercicio y lo obligarán a hacerlo, el comprador de opciones gana dinero.

Debido a que no ha adquirido otra opción para comprar acciones, como por ejemplo mediante una venta en corto de acciones de la misma empresa para reducir su precio de compra, la opción se considera "desnuda".

Pero tenga en cuenta que los inversores novatos no deberían intentar esto por su cuenta considerando el riesgo que implica.

Tendencias

Convertirse en empleado del BAfD: ¡hasta ₦ 1.341.131 de salario según el puesto!

El BAfD es una empresa que tiene una misión muy noble y, además, ofrece un montón de beneficios para sus empleados. ¡Échale un vistazo!

Continúe Leyendo

¿Cómo solicitar un préstamo personal en Sanlam?

Si estás buscando solicitar un préstamo personal en Sanlam, has llegado al lugar indicado. ¡Consulta todo lo que necesitas para la solicitud!

Continúe Leyendo

Solicitud de un préstamo personal del Standard Chartered Bank: puede pedir prestado hasta ₦35 000 000

Si desea aprender paso a paso sobre cómo solicitar un préstamo personal en el banco Standard Chartered, ¡siga leyendo!

Continúe LeyendoTambién te puede interesar

Tarjeta de crédito Discovery Bank Gold ¡Reseña completa!

Discovery Bank es una institución que está intentando cambiar algunas reglas sobre cómo funciona la "banca tradicional". ¡Vea si la tarjeta se ajusta a sus necesidades!

Continúe Leyendo

Postúlate en APM Terminals: ¡₦3,500,000 por año puede ser tu salario!

Si quieres trabajar en APM Terminals, quieres entender el proceso de solicitud y también obtener algunos consejos, ¡este es el artículo para ti!

Continúe Leyendo