Loans

Applying for an Ecobank Personal Loan – ₦100,000 same-day loan!

If you are looking for a good place to get a fast personal loan, regardless of the reason, then Ecobank might be an excellent option!

Advertisement

Learn more about the company!

Welcome to our in-depth analysis of Ecobank Personal Loans, where we examine the financial products and services provided by one of the top banks in Africa.

Ecobank, a regional commercial bank with operations in several African nations, has established itself as a major force in the continent’s economic growth.

We will give you a quick rundown of the company’s history and offerings in this post.

More significantly, we’ll examine how Ecobank’s personal loans operate and provide insights into the various features and advantages they offer.

Join us to learn how Ecobank combines financial flexibility, competitive rates, and accessibility to meet your various needs, whether you’re thinking about a cash-backed loan, mortgage loan, or advance facility.

Recommended content

A quick overview of the bank

Having been established in 1985, Ecobank has become a significant player in the banking industry in Africa, with more than 70 years of experience.

The bank’s origins can be found in its founding as a member of the wider Ecobank Group, which demonstrates its dedication to promoting economic growth throughout sub-Saharan Africa.

With operations in many African nations, Ecobank has developed into a major regional commercial force over time.

With Chief Executive Officer Jeremy Awori at the helm, Ecobank has established itself as a byword for dependability, consistency, and a customer-first philosophy.

As Africa’s Global Bank, Ecobank’s history is characterized by dedication to service excellence and contributions to the economic growth of the region.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

How do Ecobank Personal Loans work?

The personal loans from Ecobank provide borrowers with flexibility and accessibility to meet a range of financial needs.

One of the options is the mortgage loan, which can be renewed every thirty days and has fees based only on the amount used.

Customers of Ecobank who have kept an account open for at least three months are eligible for this option.

Borrowers can obtain a portion of their net monthly salary through the Advance Facility in cases where quick financial solutions are needed.

Furthermore, individuals with existing deposits or investments can access funds without liquidating their investments with the Cash Backed Loan, a pre-approved low-interest option.

Using the Ecobank mobile app or by calling *326#, you can easily apply for these loans through Ecobank’s banking system.

With this USSD code, you can easily get loans up to N100,000. Ecobank offers both secured and unsecured loan options; the borrowing limits for unsecured loans are usually lower.

This all-encompassing strategy guarantees that borrowers have flexible choices to deal with their financial circumstances, whether it is paying for unexpected bills, making use of current investments, or getting a mortgage.

People are advised to consult Ecobank’s official sources for the most up-to-date and accurate information.

What are the benefits of applying for a personal loan at Ecobank?

Applying for a personal loan at Ecobank is a desirable choice for people in need of financial support because it comes with a number of benefits. Among these advantages are:

- Adaptable Repayment Schedules: Ecobank’s Personal Loan offers borrowers adaptable repayment schedules. This makes it possible for borrowers to adjust the loan repayment to suit their financial situation, guaranteeing a convenient and manageable payback schedule.

- Reduced Interest Rates: When compared to other debt types, Ecobank personal loans might have lower interest rates. They are an affordable option for funding a range of needs because of this feature, which could lower the total cost of borrowing.

- All-Purpose Use: The personal loan is intended to meet a range of monetary requirements. The money can be used for a variety of things by the borrowers, such as paying for home upgrades, personal needs, or medical bills.

- Online Application Process: It’s quick and easy to apply for a personal loan from Ecobank. For the Ecobank Xpress Loan, the bank provides an online application process that is simple to use and expedites processing.

Want to apply?

If you’re interested, feel free to take a look at our next article.

There, we are going to talk about the application process as well as the documents needed to apply. Take a look!

Trending Topics

How to apply for a personal loan at Bayport?

Check out this article if you want to learn everything you need to have a smooth application process at Bayport and get the loan you need!

Keep Reading

Futuristic Transportation: 7 Mind-Blowing Innovations Coming to South Africa Soon

Get a glimpse of South Africa's exciting future and step into the future of transportation with 7 mind-blowing innovations.

Keep Reading

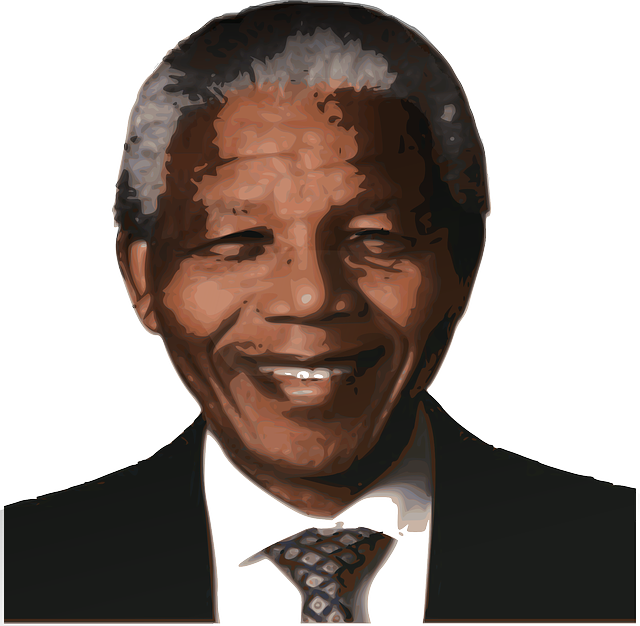

Mandela’s Hidden Legacy: 5 Lesser-Known Stories from South Africa’s Hero

Discover 5 lesser-known stories about South Africa's hero, Nelson Mandela. From his love for gardening to playing saxofone.

Keep ReadingYou may also like

Keystone Bank Personal Loan full review -Up to ₦10,000,000

Keystone Bank is a major financial institution in the country. Perhaps with such expertise, they have the personal loan you need!

Keep Reading

Discovery Bank Gold Credit Card Full review!

Discovery Bank is an institution that is trying to change some rules in how "traditional banking" works. See if the card fits its shoes!

Keep Reading

Direct Axis Personal Loans Full review!

Direct Axis is one of the most respectable and experienced companies in the country when it comes to financial help!

Keep Reading