Loans

Carbon Personal Loan full review – Up to ₦500,000

Carbon is an excellent option for a personal loan if you need a quick application process and no collateral options!

Advertisement

See if the lender fits your needs!

Explore the world of financial independence by reading our in-depth analysis of carbon personal loans.

This brief overview covers the essential features of Carbon, a prominent financial services provider reshaping the Nigerian market. Discover the company’s dedication to user-friendly solutions, inventive leadership, and global presence.

Discover the ease of use, accessibility, speedy disbursements, and flexibility of Carbon’s lending app. And learn more about the special advantages that make Carbon a dependable option for personal loans.

With the help of our succinct review, you will gain the knowledge you need to confidently and easily navigate the world of borrowing.

Recommended content

A quick overview of the company

Since its founding, Carbon App—which started out as a financial services powerhouse—has transformed into a shining example of financial empowerment.

With over 90 employees and a strong presence in Ghana and Nigeria, Carbon App was founded by Chijioke Dozie, who also serves as the CEO and co-founder of the company.

Redefining the financial landscape, Carbon App has positioned itself as a mobile-only digital bank, driven by a dedication to creative solutions.

The goal of Carbon App’s suite of services, which includes instant loans, buy now, pay later options, and savings plans, is to promote financial inclusion by streamlining financial transactions.

Carbon App, one of the greatest loan apps in Nigeria, keeps reinventing user experiences by providing easy credit access and high-caliber financial services.

Get notified of high-paying job opportunities directly in your inbox

You will be redirected to another website

How does a personal loan at Carbon work?

An easy-to-use app that transforms the loan experience is at the core of Carbon’s personal loan procedure.

After downloading and installing the app, consumers have access to a smooth online application process that allows them to apply for loans without the need for collateral or guarantors.

The entire application process is done within the app, which makes it easy to use and guarantees a quick and easy experience.

Carbon takes pride in its quick funding process, transferring approved loan amounts into the user’s account in a matter of minutes after the loan application is submitted.

In order to meet users’ immediate financial needs, this rapid funding feature aims to give users timely access to the necessary funds.

The app makes repayment easier and gives users the option to conveniently manage their repayments online.

Carbon sets itself apart from the competition with extra features like bill payments, fund transfers, fast loan approvals, no collateral requirements, and competitive interest rates.

All of these characteristics work together to create a dependable and user-friendly platform that establishes Carbon as a top option for Nigerians looking for personal loans.

What are the benefits of applying for a personal loan at Carbon?

- Simple Loan Application Process: Carbon streamlines the loan application process by doing away with the need for long forms, collateral, or guarantors. This guarantees easy and quick access to money.

- Fast Disbursement: Money is deposited into your Carbon account right away after your loan is approved. This quick disbursement guarantees that the loan amount is accessible right away, satisfying pressing financial needs.

- Flexible Loan Amounts: New clients can borrow from ₦10,000 to ₦500,000 in different amounts, depending on their needs. This adaptability meets a variety of budgetary needs.

- No Collateral Needed: Carbon provides unsecured loans without requiring collateral. The application process is more inclusive and straightforward as a result of this accessibility.

- Free Banking Transactions: Customers who have a Carbon account are eligible for free banking activities, which include the first thirty transactions being free of transfer fees. The entire banking experience is improved by this feature.

To sum up, applying for a loan through Carbon guarantees a quick, easy, and accessible way to get a personal loan without all the typical hassles that come with traditional lending.

Do you want to take a look at how to apply?

If you’re interested, then you should definitely read our next article.

Not only are you going to talk about the application process at Carbon, but also what you need to be eligible for. Take a look!

Trending Topics

Becoming a Terragon Group worker – You can earn up to ₦ 149,205 as a salary!

Terragon is a company whose business model and workplace make it a very modern and interesting company to work. Read for yourself!

Keep Reading

Nike worker review – $37,434 per year for some entry-level positions!

Nike is one of the most famous companies in the world, but is it a good place to work? Check out our article and get your answers here!

Keep Reading

What is considered an asset?

We always hear it, but sometimes we don't understand. Here we are going to understand what is an asset and give some examples.

Keep ReadingYou may also like

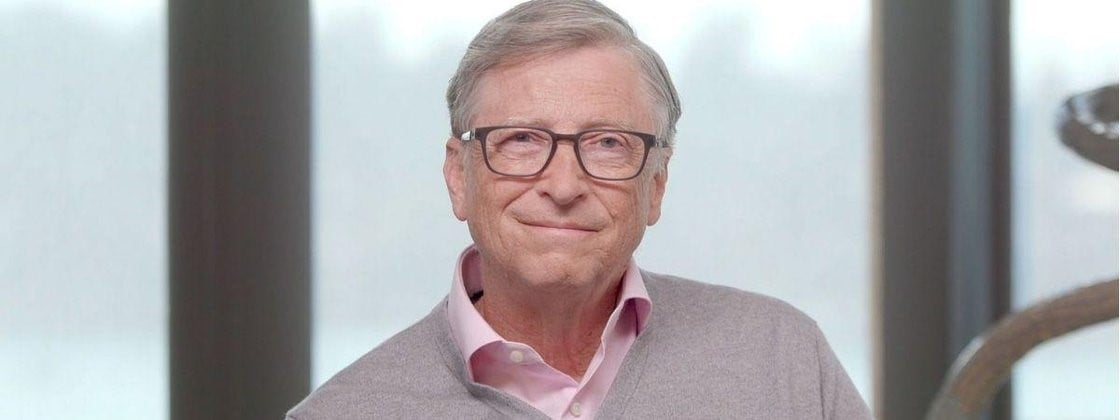

The stocks Bill Gates uses to generate a lot of income

Even a tech billionaire can use the stock market in his favor. Check out these stocks Bill Gates is using to generate income for him.

Keep Reading

How to apply for a payday loan at Letsatsi?

If you want to learn how is the application at Letsatsi, from the documents required to the process itself, keep reading this article!

Keep Reading

GTBank Personal Loan – You can borrow up to ₦50,000,000 in personal loans

GTBank loan amounts are a pretty impressive one if you are in need, alongside competitive rates and flexible terms!

Keep Reading