Credit Card USA

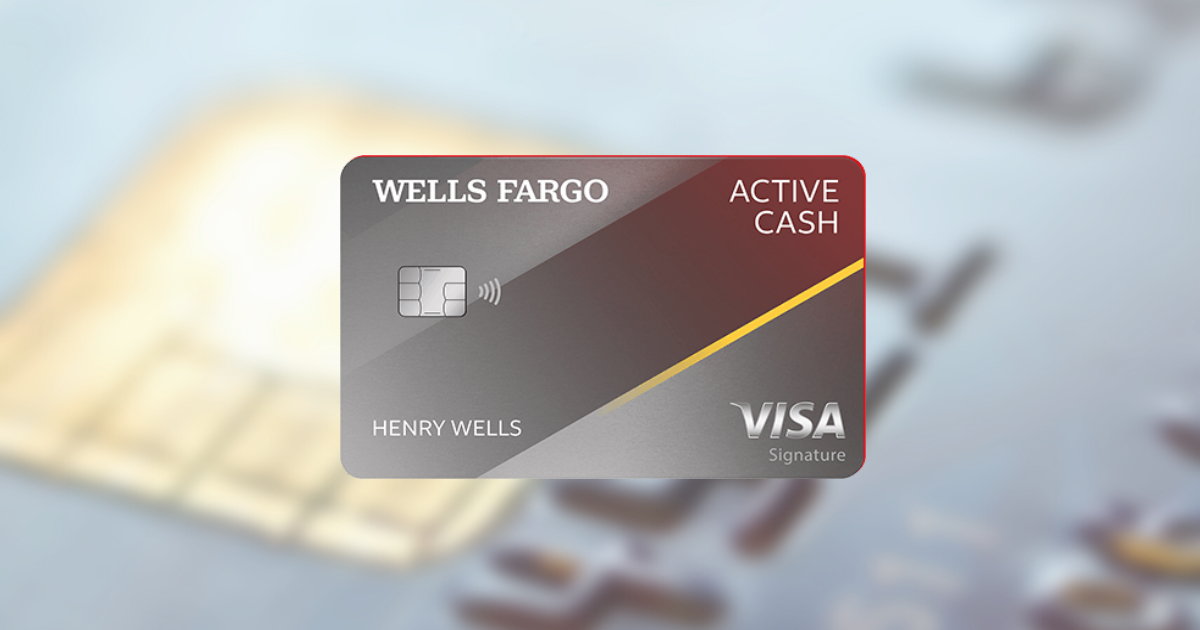

Learn how to apply for the Wells Fargo Active Cash Card!

If you want a credit card that is focused not only on Cashback but with a sign-up bonus and 0% APR, this is the one!

Advertisement

What do I need to know?

With its many perks, the Wells Fargo Active Cash® Card is a great option for anyone looking for a simple, dependable cash-back card.

Its 2% cash back on all purchases, with no spending caps or categories, is one of its best features.

You can earn rewards on a variety of purchases, including groceries, dining out, and daily expenses, thanks to this steady cash-back rate.

After spending just $500 within the first three months, new cardholders can benefit from a $200 cash rewards bonus, which offers an instant value boost.

For the first 15 months, the card also offers 0% intro APR on purchases and balance transfers, which is perfect for people who want to make big purchases or move existing debt without paying interest.

Who can apply for the card?

A few fundamental requirements must be met in order to apply for the Wells Fargo Active Cash® Card. First, you have to be a resident of the United States and at least eighteen years old.

The application also requires a valid Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN).

Although there isn’t a set minimum credit score required by Wells Fargo, applicants usually need to have a good to excellent credit score—typically 670 or higher—to improve their chances of being approved.

Additionally, to prove that they can pay back any outstanding balances, they must have a steady source of income. During the application process, Wells Fargo will examine your credit history as well as other financial information, including your debt-to-income ratio.

Applicants who already have a Wells Fargo consumer account may find the process easier, though it is not a requirement. Lastly, Wells Fargo may perform a soft inquiry to determine your eligibility without lowering your credit score if you apply online, in person, or over the phone.

You will be redirected to another website

How does the application process for the Wells Fargo Active Cash Card usually unfold?

You can apply for the Wells Fargo Active Cash® Card online, over the phone, or in person. The application process is easy to understand and straightforward.

Applicants must first submit basic personal information, including proof of U.S. residency, income information, and their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

To improve their chances of being approved, Wells Fargo normally requires applicants to have a good to excellent credit score, usually 670 or higher.

Wells Fargo will evaluate your eligibility after you submit your application by looking over your credit history as well as other financial data like your income and debt levels.

Without affecting your credit score, they might run a soft inquiry on your credit report.

If accepted, the card will be mailed to you along with an initial credit limit determined by your financial situation.

All things considered, the procedure is brief, and you can begin taking advantage of the card’s benefits and rewards right away after being approved.

More Details

For people who wish to earn rewards without incurring additional fees, the Wells Fargo Active Cash® Card is accessible and reasonably priced, as it has no annual fee.

Additionally, it offers useful benefits like 24/7 Visa Signature Concierge service for help with travel and lifestyle needs, as well as cell phone protection when you pay your phone bill with the card.

Finally, it has no foreign transaction fees, which makes it an excellent travel companion.

Do you want to look at another option?

If you’re in the market for a rewards card with great travel perks, don’t miss the Capital One Venture Rewards Card.

This card offers Bonus Miles on your first purchases, plus 2X miles on every purchase you make, making it ideal for earning rewards quickly.

Additionally, it has no foreign transaction fees, which is a huge benefit for international travelers. Whether you’re booking flights, hotels, or dining out, this card offers valuable rewards.

If you’re interested in a travel-focused credit card with plenty of benefits, be sure to explore the Capital One Venture Rewards Card for more information.

Trending Topics

The Ultimate Guide to Indoor Plants: 7 Low-Maintenance Choices for a Greener Home

Create a greener and more vibrant home with our Ultimate Guide to Indoor Plants and transform your home into a green oasis.

Keep Reading

Apply at Nestlé – Up to ₦ 700,000 per month!

If you are looking to learn how the application process and what can you do to be an excellent professional, check out this article!

Keep Reading

Don’t Grab These Unhealthy American Groceries on Your Next Trip to The Store

It's hard to resist. Nevertheless, we need to think about the harm accumulated in our bodies over years of consuming so much 'junk food'.

Keep ReadingYou may also like

Domino’s worker review – $36,784 per year can be your average salary!

In this article, we are going to delve deep into what it is to be a Domino's employee, the benefits, and the opportunities!

Keep Reading

Applying as a Warehouse worker – $33,113 per year looks good for you?

Do you want to improve your odds of getting an excellent job as a warehouse worker? Then, read this article and learn more!

Keep Reading

YouVersion Holy Bible app full review

If you want to keep improving your spirituality and keep the words that are sacred to you, close, check out this app right away!

Keep Reading