Préstamos

¡Revisión completa de Sunshine Payday Loans!

¡Sunshine es el tipo de prestamista que quiere cambiar el panorama, con sus pagos rápidos y su proceso de solicitud sin papeleo!

Anuncios

¡Hasta R4.000 en préstamos de día de pago!

La necesidad de obtener una solución financiera confiable y eficaz aumenta en épocas de necesidades financieras imprevistas. Aquí tenemos Sunshine Payday Loans, una empresa de confianza en Sudáfrica que ofrece soluciones de efectivo rápidas y prácticas.

En este análisis exhaustivo, examinamos las características y ventajas de Sunshine Payday Loans para explicar por qué se ha convertido en una opción popular para muchas personas que tienen dificultades financieras a mitad de mes.

Sunshine Loans ofrece préstamos de día de pago sin complicaciones para ayudar a las personas a superar la brecha entre cheques de pago porque reconocen el valor de los préstamos responsables.

La empresa se compromete a ofrecer a los prestatarios condiciones de préstamo transparentes y asequibles, garantizando accesibilidad y asequibilidad.

Dicho todo esto, ¡vamos directo al grano!

¿Quién es Sunshine?

En Sudáfrica, Sunshine Payday Loans es un proveedor respetado de soluciones financieras rápidas y prácticas.

Sunshine Payday Loans se ha establecido como una marca respetable en el sector de préstamos al concentrarse en ayudar a las personas a superar la brecha entre cheques de pago en medio de crisis financieras imprevistas.

La institución, que opera en línea, ofrece un proceso de solicitud más rápido que elimina el papeleo engorroso y las largas filas.

Los prestatarios pueden solicitar rápidamente préstamos de R500 a R4,000 a través de su plataforma en línea, con períodos que generalmente varían de 4 a 49 días.

Sunshine Payday Loans se enorgullece de su compromiso con la satisfacción del cliente y cumple con todas las normas establecidas por el Regulador Nacional de Crédito (NCR).

Dan alta prioridad a la seguridad financiera de sus clientes, prestando atención a la asequibilidad y a los patrones recientes de pago en lugar de solo a las calificaciones crediticias.

Sunshine Payday Loans se ha establecido como una opción confiable y práctica para aquellos en Sudáfrica que necesitan asistencia financiera a corto plazo gracias a su dedicación a los préstamos responsables, el proceso de solicitud sin complicaciones y el compromiso con la felicidad del cliente.

¿Cómo funcionan los préstamos de día de pago de Sunshine?

Sunshine Payday Loans es un prestamista en línea sudafricano que se especializa en ofrecer préstamos de día de pago rápidos y prácticos.

La empresa ofrece un proceso de solicitud eficaz y fácil de usar que puede completarse completamente en línea, con énfasis en aliviar las necesidades financieras a corto plazo.

Las personas pueden ir al sitio web de Sunshine Payday Loans y completar el formulario de solicitud en línea para solicitar un préstamo de día de pago.

Si se acepta, los fondos del préstamo generalmente se desembolsan en menos de 24 horas, lo que permite a los solicitantes obtener el dinero que necesitan de inmediato.

Dependiendo del contrato de préstamo exacto, los préstamos de día de pago Sunshine tienen períodos de pago que varían de 4 a 49 días.

Para mantener la transparencia y brindarles a los prestatarios la información que necesitan para tomar decisiones inteligentes, el monto del préstamo, las tasas de interés y cualquier otro costo se dan por adelantado.

Sunshine Payday Loans enfatiza los procedimientos de préstamo éticos y valora la seguridad financiera de sus clientes.

Su objetivo es ofrecer condiciones de préstamo breves y transparentes para que los prestatarios puedan comprender completamente los gastos y obligaciones antes de tomar el préstamo.

En general, Sunshine Payday Loans trabaja para brindar una opción práctica para las personas que necesitan efectivo de emergencia.

¿Cuáles son los beneficios de solicitar un préstamo en Sunshine?

- Nada de papeleo: Sunshine Loans ofrece un proceso de solicitud en línea sencillo que elimina la necesidad de realizar trámites que consumen mucho tiempo. Puede presentar una solicitud de préstamo desde la comodidad de su hogar.

- Asequible: Los reembolsos de los préstamos se realizan de manera económica y razonable gracias a Sunshine Loans. Para elaborar una estrategia de reembolso que se ajuste a su presupuesto, analizan su situación financiera.

- Solicitud de préstamo en línea sencilla: Sunshine Loans ofrece un proceso de solicitud de préstamo rápido y sencillo. Puede navegar por el formulario de solicitud y enviarlo junto con los documentos necesarios gracias a la interfaz fácil de usar del sitio web.

- Pago rápido: Sunshine Loans trabaja para otorgar aprobaciones de préstamos rápidas, ya que reconocen la urgencia de las necesidades financieras. Una vez que se haya autorizado su préstamo, puede esperar que el dinero se transfiera a su cuenta bancaria dentro de las 24 horas, lo que le dará tiempo suficiente para ocuparse de sus responsabilidades financieras.

¿Quieres ver cómo aplicar?

Si estás interesado no olvides consultar nuestro próximo artículo.

Allí nos centraremos en los documentos necesarios para postular y cómo funciona el proceso de solicitud, ¡así que prepárate y echa un vistazo!

Tendencias

Postúlate en PwC: ¡puedes ganar hasta ₦2,4 millones al año!

Si quieres aprender cómo postularte para PwC y no sólo eso, cómo ser un empleado destacado, ¡mira este artículo!

Continúe Leyendo

Aplicación de la UEFA Champions League: cómo descargarla y disfrutarla

¡Esta aplicación es gratuita! Lo único que necesitas es un teléfono celular para descargar la aplicación UEFA.TV y seguir lo mejor del fútbol mundial.

Continúe Leyendo

Préstamos UBA: ¡Hasta ₦30.000.000 en préstamos!

Si estás buscando un buen préstamo personal, con excelentes condiciones y rapidez, ¡quizás Banco UBA pueda ayudarte!

Continúe LeyendoTambién te puede interesar

Solicitud de admisión a un curso relacionado con Ciencias Sociales Computacionales

¡Echa un vistazo a este artículo si quieres inscribirte en un curso que te permitirá utilizar tu ordenador para comprender mejor la sociedad!

Continúe Leyendo

Reseña de un trabajador de Chick-fil-A: ¡$63,701 por año en promedio!

Chick-fil-A es una empresa que ofrece un buen salario, una gran cantidad de beneficios y una cultura laboral muy interesante. ¡Conoce más!

Continúe Leyendo

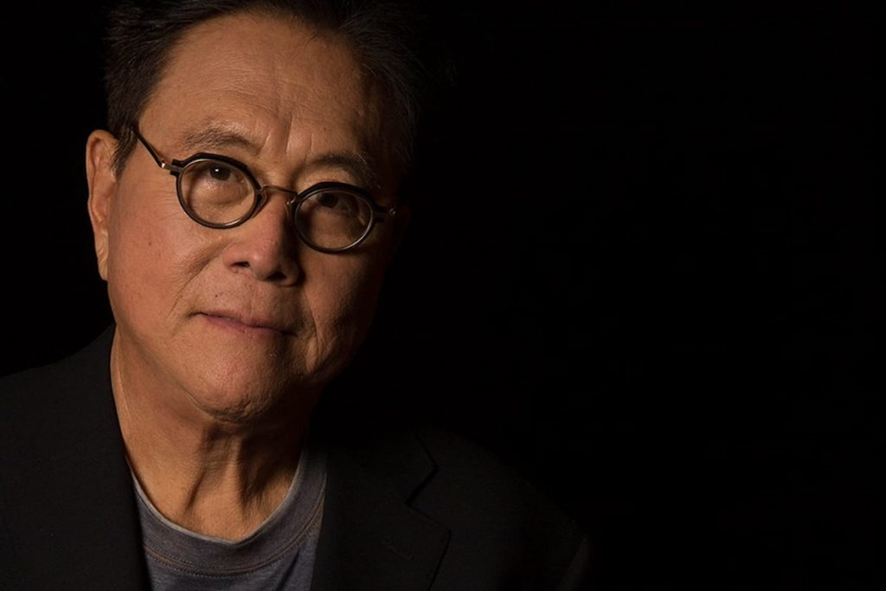

Cosas que 'Padre rico, padre pobre' se equivocan

Algunos lo consideraron un "clásico" por buenas razones, pero algunas afirmaciones no parecen del todo correctas o están desactualizadas. Descubra algunos de ellos.

Continúe Leyendo